Top Flex Buy Benefits

Lower Monthly Payments

Get reduced payments for the first three years.

Own Your Vehicle

Your vehicle belongs to you at the end of the term.

Avoid Lease Restrictions

Say good-bye to restrictive mileage limits or wear-and-tear charges.

Fixed Interest Rate

Enjoy transparent and predictable payments for your entire contract.

Tailored Financial Options

Browse multiple term and payment options to fit your needs.

Build Equity

Gain greater financial flexibility for future decisions.

Understanding Flex Buy Financing

What is Flex Buy?

Flex Buy is an exclusive financing option from Ford Credit designed to make ownership easier. It features a flexible payment structure, including initial lower monthly payments. Flex Buy is perfect for people who would rather own than lease their next vehicle and want the payment flexibility of lower initial payments.

How does the Flex Buy program work?

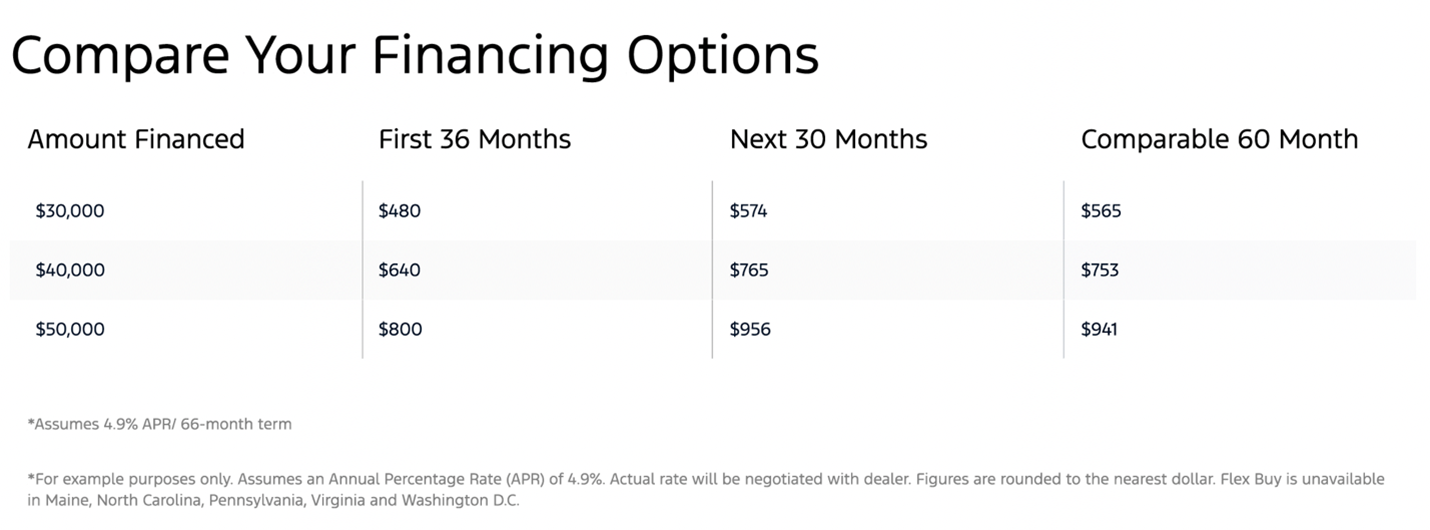

Flex Buy has two term options, 66-months or 75-months, and a fixed interest rate for the entire length of the contract.

For the first 36 months of either term, you’ll enjoy lower monthly payments.

At month 37, your monthly payment will increase for the remaining term of the contract, allowing you to pay off the balance in full by the end.

When all your payments are completed, the vehicle is 100% yours.

What Flex Buy Isn’t (and Why)

Let’s clear up some common misconceptions about Flex Buy and talk about what makes it different.

Flex Buy is not a lease.

You’re financing the purchase of your new vehicle from day one. Unlike a lease, there are no mileage limits, no wear-and-tear charges, and no need to return the vehicle at the end of your term.

Flex Buy is not a balloon loan.

A balloon loan has a large, lump-sum payment due at the end of a short term. Conversely, Flex Buy is a retail contract with an unequal payment schedule; the first 36 months have lower payments, which then increase at month 37.

Flex Buy does not have a variable rate.

You’ll have a stable, fixed interest rate for your entire contract. The planned payment increase is due to the structure of the principal repayment, not a change in your interest rate.

Is Flex Buy Right for You?

There are several things to consider when deciding how to finance a vehicle. Take a moment to ask yourself these questions:

Do you like to trade your vehicle every few years?

With Flex Buy, you’ll have the opportunity to trade in your vehicle whenever you’re ready, just like with traditional financing.

Is your income expected to grow within the next three years?

Flex Buy’s initial lower monthly payment provides customers with some financial flexibility up front.

Are you trading in a vehicle with equity or making a down payment?

By reducing the total amount you finance from the start and pairing it with one of Ford’s low APR programs, your initial monthly payment will be even more affordable.

Are you uncomfortable with lease mileage limits or concerned about early termination penalties?

Since you own your vehicle, you don’t have to worry about being penalized for mileage overages or the early termination charges common with a lease.

Is longer-term vehicle financing just not your thing?

Whether you’re hesitant about the prolonged repayment period or wanting to get into something new again, Flex Buy offers an alternative.

Frequently Asked Questions

Unlike traditional financing, Flex Buy structures your payments to be significantly reduced for the first three years (or 36 months), providing immediate financial flexibility. Because of this, you can enjoy your new vehicle today, while building equity and preparing for your future financial growth, all with a clear, fixed-rate plan.

With Flex Buy, you’ll enjoy lower monthly payments for the first 36 months. Then at month 37, your monthly payment will increase by a single predetermined amount (based on your individual contract), allowing you to pay off your vehicle in full by the end of your 66- or 75-month loan term.

Yes. Like a typical sales agreement, Flex Buy is a regular term contract — it just has an unequal repayment schedule. It can be paid off at any time, without penalty.

There are no specific down payment requirements. You can work with your dealer to figure out a deal and repayment structure you’re comfortable with.

No, but you can see if you prequalify here! It takes less than five minutes and will have zero impact on your credit report.

Flex Buy is available in every state except for Maine, North Carolina, Pennsylvania, Virginia and the federal district of Washington D.C.